July Real Estate Market Overview

We’ve all heard the news that the market is shifting, and so, if you are thinking of buying or selling a home, that may leave you wondering: What’s happening to my house value? Is it still a good time to buy a home? Should I make a move this year?

Mortgage Rates

While one of the big questions on all buyers’ minds is where will mortgage rates go in the months ahead. No one has a crystal ball to know exactly what will happen in the future, but some forecasters in the industry are now saying that the record-low mortgage rates during the pandemic were an outlier, rather than the norm.

The recent Fed rate hike is unlikely to further damage mortgage borrowers. The long-term bond market, on which mortgage rates are generally priced, has mostly priced in all future actions by the Fed. According to Lawrence Yun, chief economist for the National Association of REALTORS, “it is possible that the 30-year fixed-rate mortgage may settle down at 5.5% to 6% for the remainder of the year. Therefore, home sales could soon stabilize within a few months, and then steadily turn upwards from early next year.”

Home Price

The pandemic led to record-breaking increases in home prices due to the imbalance between the number of homes for sale and the number of buyers. Nationally, homes appreciated by 15% in 2021, and locally, by 14.6 %. Both markets have continued to rise this year.

Even though housing supply is increasing, there are still more buyers than there are homes for sale, and that is maintaining the upward pressure on home prices. This may account for why industry forecasters are not calling for prices to decline, but rather to continue to climb, just at a more moderate pace, this year. Nationally, on average, homes are projected to appreciate by about 8.5% in 2022

What This Means for Sellers and Buyers

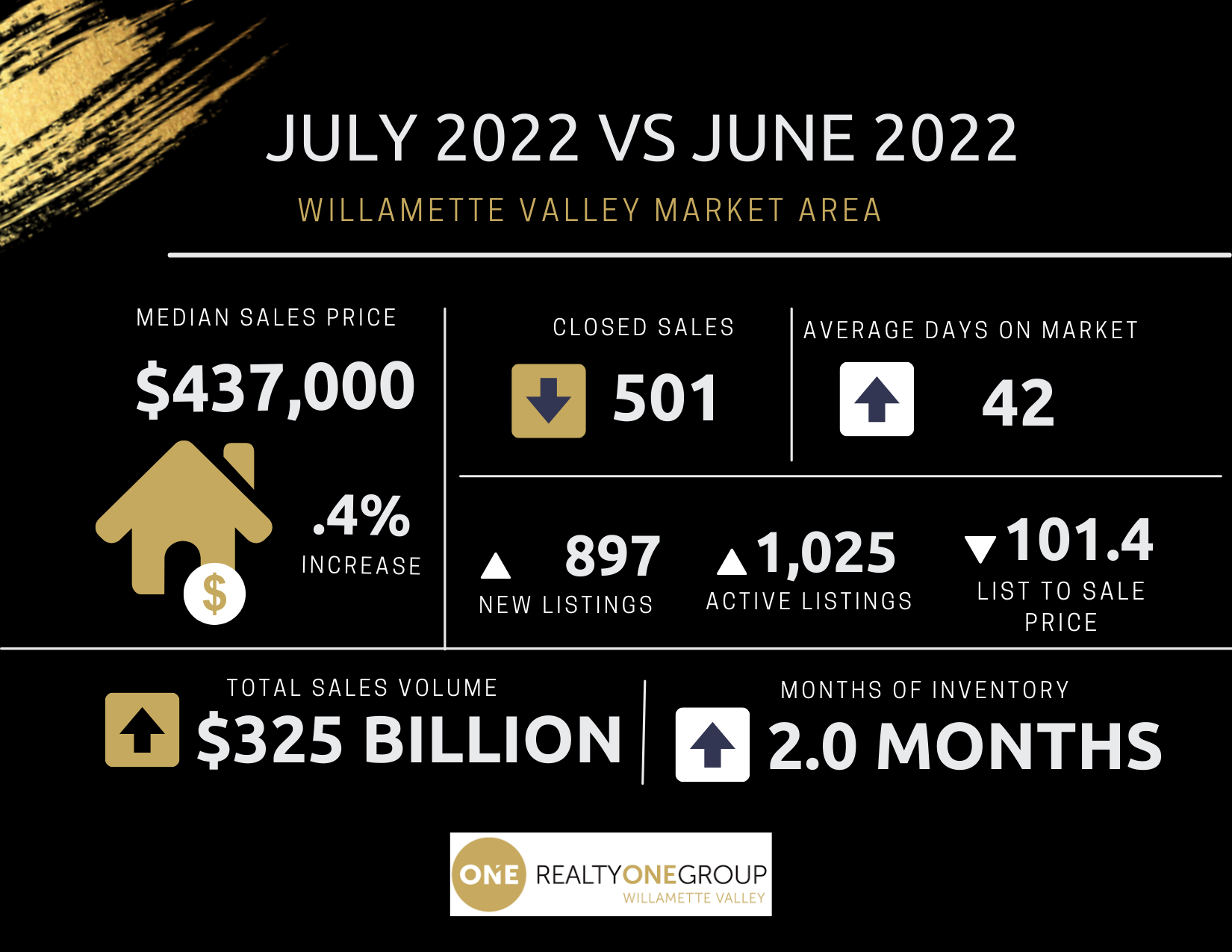

Home prices will still be appreciating, but at a slower, more sustainable level. If you are thinking of selling your home, it may now take more than two days to get an offer. A balanced market is six months of inventory; locally we are at two months’ inventory: meaning, it is still a seller’s market. With the frenzy having slowed it is now easier to buy, and sell, at the same time.

While housing supply is still low, there are more homes to choose from. As a buyer you have may have more leverage and negotiating power. Also, the rate you are financing today doesn’t have to be permanent. Rates will fluctuate, as history has proven. When they do, that will be the time to refinance at the lower rate.

Bottom Line

The market is correcting itself. Low interest rates, and crazy overbidding was not a sustainable trend. As local data shows, it is still a good time to buy, or sell. As your local market expert, I can help you understand the finer points of the market that impact sales and home values in your own neighborhood.

Sources:

- Keeping Current Matters

- Realtorcom

- National Association of Realtors

- CoreLogic